Accountant Pool Shrinking... Which Means Startup Opportunities Grow

CRE tech startups in real estate accounting and fund administration

If you’re at Blueprint this week, come say hello! I’ll be moderating a panel with the incredible Betsy Reed, SVP Technology at Starwood, and Zander Geronimos, Head of North America for PRODA. Our panel is at 2:40pm in Palazzo B on Thursday. We’ll discuss how big data is transforming CRE. See you there!

When I meet new people and give my career spiel, I often joke that I’m a “recovering accountant.” I started my career working at one of the Big 4 public accounting firms. After three years of lower pay and longer hours than my investment banking friends, I found an escape route and ran towards it as fast as I could. In case you were unaware, I’m not the exception; I’m the norm. There’s a massive accountant shortage. So many of us CPAs were lured into the profession with the promise of a fast-track career and multitude of opportunities.

But that’s not what happened.

Instead, we were stuck with boring, “does this match that” work that arguably could have and definitely should have been done by a computer. And while the partner payroll was enticing, the narrowness of the funnel to get there meant that for most of us, waiting a decade to be “partner-track” wasn’t worth it.

At Business Insider, Emmalyse Brownstein describes it well:

Accountants have become an endangered species, and that's endangering the financial ecosystem. But bolstering their ranks is no easy feat.

"The pay is crappy, the hours are long, and the work is drudgery," said Richard Rampell, a retired accountant in South Florida. "And the drudgery is especially so in their early years." …

The mass exodus of accountants has already impacted publicly traded firms: Advance Auto Parts, Tupperware, and on the real estate side, Compass. Each firm cited the shortage of accountants as a reason for their material misstatements and other accounting-related issues. At Compass, “They specifically state it’s a lack of appropriate level of experience and training,” said Jeffrey Johanns, a professor at UT. “That indicates it’s an accounting personnel problem … Effectively it could affect all controls.”

The Real Deal further notes:

Compass also did not maintain effective controls over its IT systems relevant to its financial reporting, including measures related to access to sensitive financial data. A company executive said the IT weaknesses were focused on tracking and documenting login access.

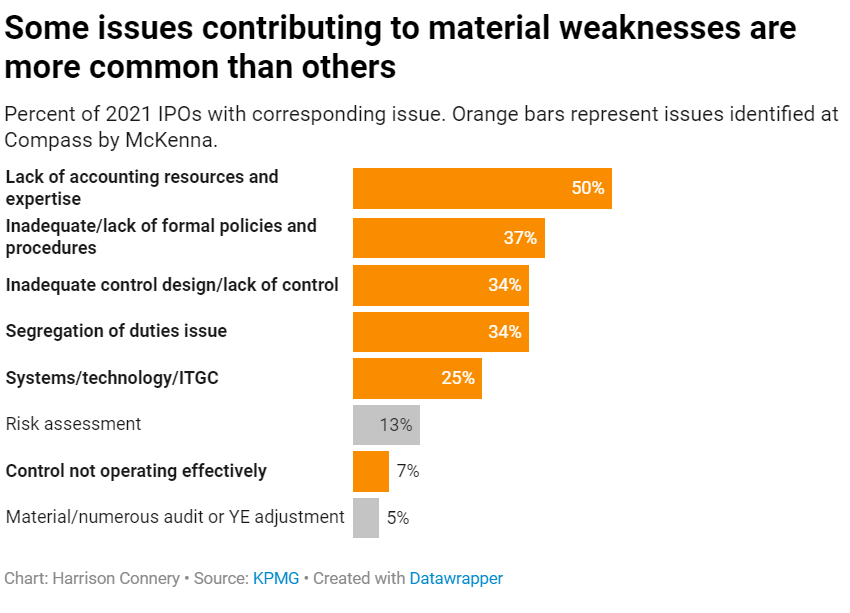

Over the past five years, between a quarter and half of all traditional firms that IPO’d reported some kind of material weakness, according to data collected by KPMG.

If you’re not bought into the massive accounting shortage issues yet, check out their graph below. The winner for the top issue contributing to material weaknesses in IPOs is (drum roll, please)… “lack of accounting resources and expertise.”

In case you’re not an accounting nerd like yours truly, a material weakness is when a company has an insufficient internal control that could result in a material misstatement.

Okay, I get that that wasn’t all that helpful. Let me try again.

An internal control is a process or procedure that helps an organization have reliable financial reporting and comply with laws.

A material misstatement is an error in a financial statement that is large enough to lead a user of the financial statement to draw an incorrect conclusion about an organization’s performance.

Better?

Thanks for indulging me while I shook the rust off my CPA creds. 😊

This all makes me wonder… if the shortage of accountants impacts the public sector this much (which is highly regulated and probably better paying) what’s going on in the private sector?

Anecdotally, I know several CFOs at commercial real estate firms who struggle to find and retain accounting talent. Most succumbed to some form of outsourcing.

This has been the case in fund administration for at least a decade, if not longer. Yes, investors often push for fund administration to be done by a third-party in the name of separation of duties. But fund administrators are really just consultants; they aren’t auditing data or performing any sort of validation service.

Firms like Baker Tilly also offer property and firm level accounting-as-a-service. As accountants leave our industry, I expect they will grow quickly. Then, we’ll see the other large accounting firms follow suit.

But is this always an effective solution? Even the firms that offer outsourcing services struggle to find and retain accounting talent. The bigger trend—and certainly the more interesting one to me—is the tech growth in both fund administration and real estate accounting.

Firms like Occupier automate lease accounting.

Maybern automates waterfall calculations in fund administration.

New property management accounting software keeps fighting the good fight against industry incumbents. Rentvine seems to be making strides.

And there are too many AVM (automated valuation model) startups to name.

Software opportunities in real estate accounting and fund administration continue to grow as the accountant pool shrinks. What are your favorite accounting-related startups? DM me; I’d love to hear about them.

Jen’s Reading Corner

The decline of accounting as a career makes me quite sad… I’m one of those weirdos who actually liked accounting. There’s always a big puzzle waiting to be solved! And for those that don’t know, I liked it so much that I overstudied and won an award for my CPA scores. If you’ve met my parents, odds are that they have already told you about this (I hope that I brag on my kids as much someday).

Matt Levine agrees with me on accounting. If you don’t subscribe to his newsletter, you need to start ASAP. He’s a fantastic writer for Bloomberg. He recently wrote about accountants, and for my own nostalgia of why I went into the field, I’m copying his words for you below.

Well I think accounting is cool. Accounting, like tax law or Ancient Greek, has this pleasing constellation of features:

It is an arcane and detailed body of knowledge, so if you have a detail-oriented, trivia-loving cast of mind, you might enjoy it, and if you become good at it people will be impressed at all the random stuff you know.

But it’s not random. Despite the arcana, it is a fundamentally principled body of knowledge: The rules fit together in a largely sensible way to achieve some core goals. In accounting, the basic goals include accurately and usefully presenting a company’s financial position, accurately reflecting changes in that position, etc.

It is a social body of knowledge: Accounting rules are made by committees based on human experiences; they are not given facts of the natural world. Understanding people helps you understand accounting, and vice versa.

If you understand the principles deeply and study all the arcana, you can find little glitches, little places where the actual rules can be used to accomplish things that seem to contradict the deep principles. In tax law, the glitches tend to have the form “make income disappear.” In accounting, the glitches tend to have the form “make income appear out of nowhere.” Finding those glitches is a satisfying intellectual endeavor and a way to demonstrate to yourself that you have truly mastered both the principles and the details.

Also, if you are good at finding those glitches, you can turn them into a lot of money. (This does not work with Ancient Greek.)

Does that sound appealing to you? Probably most of you are saying “what, no,” and a substantial minority of you are like “yes, that does sound cool, that is pretty much what I do in my job as a [derivatives structurer][distressed credit investor][software engineer][fintech founder][financial fraudster], though I probably get paid more than the accountants,” and a few of you are like “I am an accountant and that doesn’t sound all that much like my day job,” and then one of you is going to email me to be like “I am an accountant at a Big Four national office and thank you for appreciating my art.”

If you like All About CRE and want to support my work:

💎 Become a paid subscriber

☕ Buy me a coffee

📧 Forward this to a friend and invite them to subscribe at jentindle.substack.com

Jen, I enjoy your writing so much. The industry is fortunate to have such a sharp and witty leader. The trends towards outsourcing, frustration with hiring and retaining are all real things happening I see with my clients. The fact is few are innovating and moving through this business reality- but the ones who are rethinking strategy and embracing technology around their accounting and talent are developing that competitive edge. I love advising clients and being that partner in evolving best practices. Ping me and let's grab coffee soon!