System Overload: Part 1

How to choose real estate tech among a plethora of options

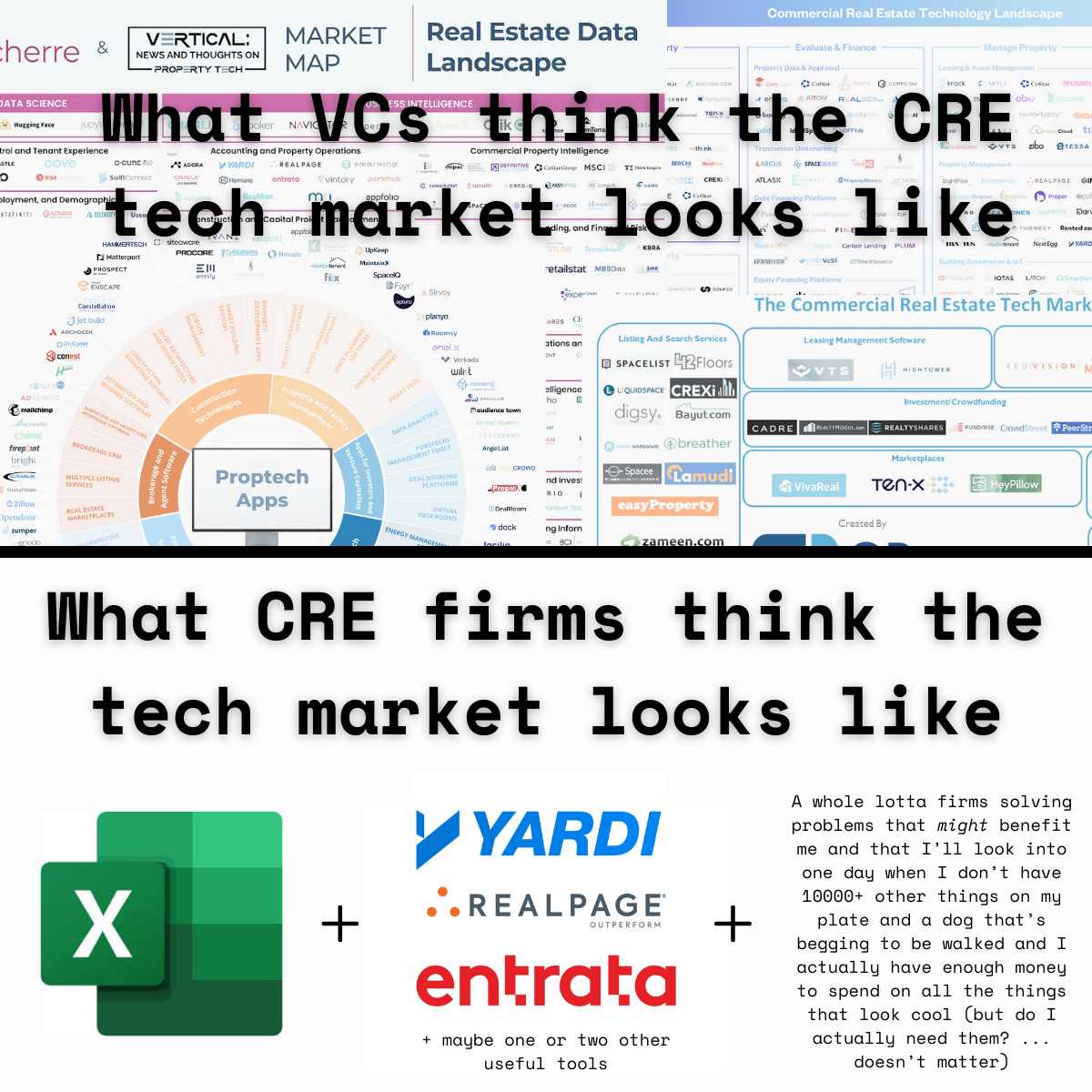

After seeing so many VCs post versions of these “CRE tech market maps”, I couldn’t help but think to myself, “Are you kidding me? What real estate firms truly have the time and budget for all of these tools?!”

Okay, fine, the big guys do. But we’re talking about an industry comprised largely of Davids with a small number of Goliaths.

Most real estate firms struggle with tech overload. In fact, this series was partly inspired by a reader’s request. Their note, edited for anonymity, is below. Btw, I love requests! Keep ‘em coming.

One thing I really struggle with is understanding which of the 1,000 prop tech companies I get pitched actually would be beneficial to me so I'm hopeful you can lean into that.

They’re not alone. Daniel Kahneman wrote, “Wherever there is judgment there is noise - and more of it than you think.”

We have a seemingly indefinite number of tech vendors to choose from, yet we have limited time to allocate for decision-making and limited budget to spend. How do we choose what tools to use?

The commercial real estate industry is too broad for me to prescribe specific solutions for each problem set. Instead, I will give you a framework for decision-making. I used this framework as a buyer of commercial real estate tech (aka CRE tech) and as a tool when I was selling software to real estate firms. That will be the focus of part 2 in this series. Get excited!

Before we can understand how to approach CRE tech decision-making, we must understand why we encounter system overload. And to do so, we’re traveling back in time to my university behavioral finance course.

Psst… startups, this post is just as much for you as it is for CRE firms. You need to understand your prospective customers’ dilemma.

Analysis paralysis and why I hate shopping

Alright, you caught me… I don’t hate shopping. But I do despise the feeling of being inundated with choices. In a low stakes game like shopping for new shoes, I simply avoid it until absolutely necessary.

In a high stakes game with hundreds of thousands of dollars AND potentially your reputation on the line, it makes sense why many real estate professionals get paralyzed by needing to analyze thousands of CRE tech firms.

Let’s review the 5 psychological principles that prevent us from making decisions.

-

1. Prospect theory and loss aversion

Daniel Kahneman and Amos Tversky invented the idea of prospect theory, which Wikipedia defines below.

Based on results from controlled studies, [prospect theory] describes how individuals assess their loss and gain perspectives in an asymmetric manner (see loss aversion). For example, for some individuals, the pain from losing $1,000 could only be compensated by the pleasure of earning $2,000. Thus, contrary to the expected utility theory (which models the decision that perfectly rational agents would make), prospect theory aims to describe the actual behavior of people.

In general, we avoid loss like the plague.

As discussed in The Psychology of Investing, one method to reduce the pain from loss is by following the crowd. Misery loves company.

The pain from loss is exacerbated when you feel a strong illusion of control.

2. Illusion of control

We often believe that we have control over whether a new CRE tech tool will succeed. Three main factors contribute to this bias:

Choice: Because we believe that the decision we make will greatly impact whether the new tool succeeds at our firm, we feel as though we can control the success of said tool.

Information: The vast knowledge available simply by googling a problem (or using ChatGPT) makes us feel as though we should be experts in each problem set area. With enough information, surely we can control the outcome.

Active involvement: Many CRE tech decision-makers also implement technology for their firm. Being in the weeds of each tool, they believe they can control how beneficial it is.

Far and away, the most important factor here that slows down or prevents decision-making is information.

3. Confirmation bias

Analysis paralysis requires that you feel as though there is a right or wrong answer. This belief in accurate predictions stems from confirmation bias, which is defined as:

“the tendency people have to embrace information that supports their beliefs and reject information that contradicts them”

Our innate human nature desires clear right and wrong answers to every problem. That is why we seek information to back up, aka confirm, our stances.

And when we’re bombarded with noise about tons of products that might help us, we want to know for certain whether they will work… or not. Of course, we can’t know that for sure, so we end up failing to make a decision at all.

4. Regret of omission vs. regret of commission

In tandem with confirmation bias, we have a sincere fear of being wrong. Let’s say we had the opportunity to use a software to solve a problem and chose to keep doing what we were doing instead. Fast forward, and all of our competitors now use it and are crushing us. Uh oh.

That’s the regret of omission.

…

Regret of commission is when we did make a choice to use a software, but we picked an also-ran. The sting from this type of regret is much more pronounced than the former.

5. Mental accounting

Given the plethora of CRE tech startups, you’re bound to pick one that fails. As part of the illusion of control, you think that your decision to go with that firm makes you bad at choosing CRE tech. Perhaps you keep score of the “bad” decisions and surmise that you aren’t good at choosing tech. Or more likely, you write off that segment of the business as an area where you’re not good at identifying tech.

-

These 5 psychological principles help us to understand why we are slow or unable to make decisions about what CRE tech to use. Next week, we will explore how to manipulate ourselves (and others) into making better, faster decisions.

Jen’s Startup of the Week

Maybern provides the simple and powerful system of record for private funds.

I caught up with a colleague recently who told me about her group of real estate CFO friends. She couldn’t wait to get them together and talk about their exciting 2024 plans! To her dismay, all they talked about was how difficult their fund admins were to work with and the inefficiency (and often inaccuracy) of their processes.

Not having a trustworthy source of truth for accounting and distribution waterfalls disrupts the core of private equity real estate fund management. Lack of transparency - or god forbid, distribution errors - with investors then makes fundraising a challenge.

Simplify your fund operations without simplifying your funds.

Jen’s Reading Corner

I recently read Scrum by Jeff Sutherland and cannot recommend it enough, regardless of whether you work in software.

In fact, my favorite section of this book was the second to last chapter on non-software applications. Sutherland describes a school in Holland that uses scrum.

“I am someone who can learn faster than others,” [the student] says. “But working together, you improve, you get better. I learn the material better by explaining it to others.” He turns to Gudith Zwartz, who is sitting across the table from him. “She knows she can ask [me] about content. I can ask her about organization. She can put it together better than I can.”

That kind of learning is part of the idea - to make unconscious skills conscious ones. Skills that can be tested on an exam are far from the only important ones. Helping students learn to identify and value different strengths in themselves and others is a twenty-first century skill. That’s something everyone needs to learn.