“Commercial real estate doesn’t have a large enough target addressable market (TAM). Venture capital can’t make the kind of returns necessary in this industry.”

- Most people these days, especially VCs who invested in CRE tech during the recent investment craze and lost a ton of $$$

I had a conversation last week with a CRE tech professional who asked about my expectations of future types of funding for CRE tech startups. As mentioned in previous posts, I’m bullish on tech-enabled CRE firms. We’re seeing more and more VCs invest in these types of companies. One of the examples I gave before was Raise, which took investment from leading Silicon Valley VCs such as Founders Fund. WeWork is another vilified and foiled example.

The pushback I always receive on tech-enabled CRE firms is that they don’t fit the standard VC-model returns. Many argue that the industry TAM simply isn’t large enough.

Call me biased, but I disagree.

There’s something else at work: a fundamental disconnect between inexperienced industry investors and founders.

Real estate’s TAM is plenty large; Statista estimates a global CRE market of $115 trillion. Further, the largest CRE firms boast total property valuations in the hundreds of billions. The problem is that most CRE tech startups never sell to the full TAM. At least not initially. Rather, their product (or service if tech-enabled) serves one niche within a niche and so on.

What do I really mean by niche within a niche, etc.? Well, let’s say you’re evaluating a startup that says they serve senior living, but really, their product is only applicable to assisted living. Starting from the top: Multifamily → Senior Living → Assisted Living. That’s a niche within a niche.

Many CRE tech startups pitch that they sell to the entire real estate industry, or perhaps to all multifamily or all commercial. Even within a country or geographic region, this often doesn’t make sense. Let me give you an example. I heard a pitch from a startup recently that said their TAM was U.S. multifamily.

“Are you selling to owners? Managers? Operators? Or some other segment?” I asked.

Their response:

This startup had a prospective first customer who was vertically integrated. When I pressed them on whether they would choose a segment to target initially, they said owners. As the pitch unfolded, I realized that this was because they sold to a firm that owned the real estate… NOT because owners would have the most to gain from their product. From their pitch, I would have thought their initial target customers were managers.

Regardless, we made it all the way through the deck and their pitch, and I still didn’t have a good understanding of who their initial target customer was.

This situation is not just an issue for the sales potential of the startup. Oh no, it has an even larger impact on VCs new to CRE.

Picture this: successful VC receives a pitch from ex-FAANG, Ivy League-educated founders with an idea to dominate our industry. The glamour of the founders’ backgrounds and charisma blurs the VC’s ability to see clearly. Sure, the VC hasn’t invested in commercial or multifamily real estate before… but they’ve made some personal investments and done quite well. They know enough to understand the industry, right?

Let’s review a couple of the psychological elements at work here.

The Endowment Effect

Many investors fall into the endowment effect trap. In general, we tend to overvalue our experience.

The endowment effect occurs when we overvalue something that we own, regardless of its objective market value (Daniel Kahneman et al., 1991). This is especially true for things that wouldn’t normally be bought or sold on the market, usually items with symbolic, experiential, or emotional significance.

In this case, investors overvalue the knowledge they “own” from making a handful of real estate investments. And they aren’t alone in their assessment. Startup founders new to the industry but with “experience” in a couple of personal investments make the same error.

This happened all too often in the last several years, and now, we’re experiencing the reckoning.

Social Proof

Discipline in investing is excruciatingly difficult; I can’t fault these investors entirely. When everyone’s investing (or looking) a certain way, you will struggle to act differently.

Social proof (or informational social influence) is a psychological and social phenomenon wherein people copy the actions of others in choosing how to behave in a given situation. The term was coined by Robert Cialdini in his 1984 book Influence: Science and Practice.

In our case, everyone and their mom started investing in CRE tech.

This effect trickles-down to CRE firms.

Revisiting System Overload

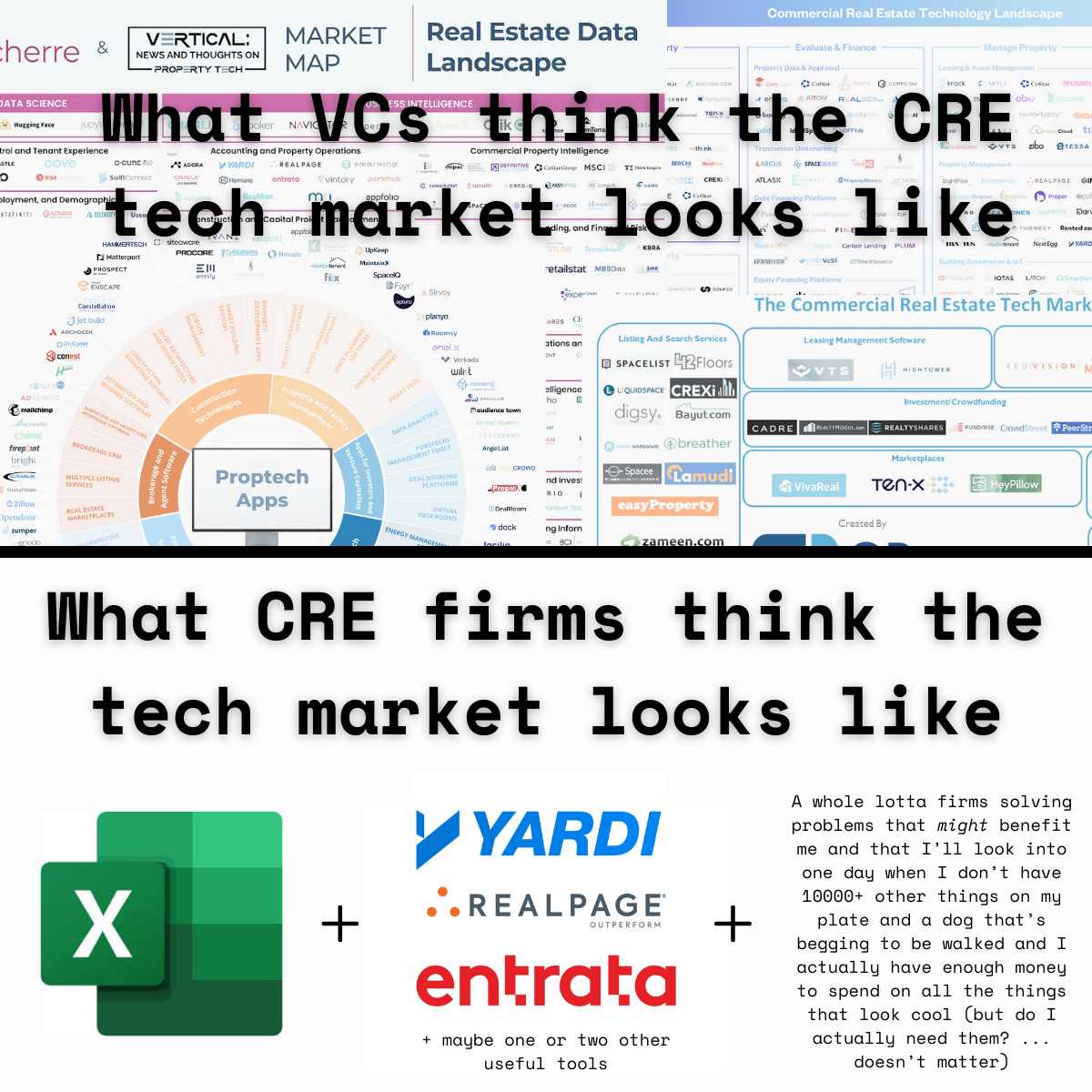

The lack of understanding of CRE niches adds to the noise of seeming like there are so many CRE tech startups. Rather than marketing to their niche, startups cast a wide net. CRE firms get confused, inundated with products that have little applicability to their business. You may remember the market map conundrum from one of my System Overload posts.

To be fair, the creators of these market maps are trying to capture all of the secondary niches. An extra layer above the one shown should make these easier to parse. At least, the average real estate firm would be better able to answer the question, “Which of these startups applies to me?” I know that I’m advocating for more work, especially given the complexity of our industry participants. But I strongly believe that clarity is kindness, and it will generate better investment results.

Back to the Question: Is CRE Tech’s TAM Large Enough for VC?

It depends.

I know, I know. That’s not the answer you wanted to hear. But it’s true.

Software will eat the real estate industry eventually, but it will do so in very different ways. Some opportunities will be incredible for venture capital, as they will be widely applicable across commercial and/or multifamily.

However, many tech solutions are point solutions serving a niche within a niche, etc. They will ultimately be absorbed into (or become) CRE firms. Or if the technology is not a differentiator for CRE firms, large tech conglomerates will buy these startups. Point solution startups will not have the return profiles necessary for VC. Yet there will undoubtedly be continued VC investment in these areas due to lack of fully understanding the niches.

My advice?

Startups, understand your target customers. No, really understand them. Do you want a modest exit or lifestyle business? Or do you want to build a unicorn? It’s in your best interest not to overpromise your potential to investors. As we said in my college basketball weightlifting classes when one of us dropped a plate, the only person you’re cheating is yourself.

Investors, understand the niches within CRE and multifamily and their respective market sizes. Resist glamour. If you don’t know the niche, either pass on the investment or find someone whose judgment you really trust.

Real estate firms, be aware of the startups trying to make your project work like a round peg in a square hole. I’m a huge advocate for more CRE firms being early adopters. That said, you need to do your due diligence to ensure the startup is setup to serve your needs (or will be by the time of implementation). This will help to ensure that your implementation goes faster and smoother.

Jen’s Startup of the Week

I met with Adam Pittenger of Moved.com last week. They continue to partner with other real estate tech platforms to grow their foothold. I’m a big fan of collaboration, as I mentioned in my post last week.

Our industry was known back then for snuffing out “competition” as quickly as possible. We at TRA, on the other hand, believe that collaboration is the real subsisting strength for organizations.

I’m super excited about one of their partnerships that’s coming soon. Follow them on LinkedIn to stay in the loop.

Jen’s Reading Corner

If you want the Cliffs Notes version of Daniel Kahneman and Amos Tversky’s theories, check out Michael Lewis’ (the author of The Big Short) The Undoing Project. It’s a delightful read that’s also educational.

If you like All About CRE and want to support my work:

😍 Plan a media partnership

🪄 Book a one-on-one CRE tech coaching session

☕ Buy me a coffee

📧 Forward this to a friend and invite them to subscribe at jentindle.substack.com

Love the dueling images of what VC thinks about CRE vs reality.