AI Isn’t Replacing Asset Managers. It’s Replacing the Mess They Deal With.

Where AI actually helps and where judgment still matters

I’m writing a series of posts about jobs I’ve done and all the ways that AI would have made that work easier. For any of you in these roles today, I’d be curious as to how you’re using AI. Comment, DM me, tell me where I’m wrong. ;)

Today’s topic is asset management.

Warning: Asset managers do A LOT of different types of work — I trimmed down my list into 9 categories of tasks with 4 in this week’s post and 5 in next week’s. For each category, I’ll rate how automatable those tasks are today and how much time asset managers could realistically save. Asset managers are the jack-of-all-trades of the commercial real estate world. As such, this is a longer than typical post even after breaking into two parts. You have been warned.

1) Financial & Valuation

Monthly reporting package review (financials, variance analysis, rent roll changes, bank statement reconciliations, loan and interest rate documentation, budget to actual comparison and explanations, construction/renovation updates, etc.) with operator or property manager

Quarterly re-underwriting (proforma, upside, downside if needed), valuation updates, and obtaining BOVs if needed from brokers (internal)

Annual budget review and approval with property manager/operator

Cash flow forecasting and distribution planning (internal)

This is the most visible part of asset management, and also one of the least automatable end-to-end.

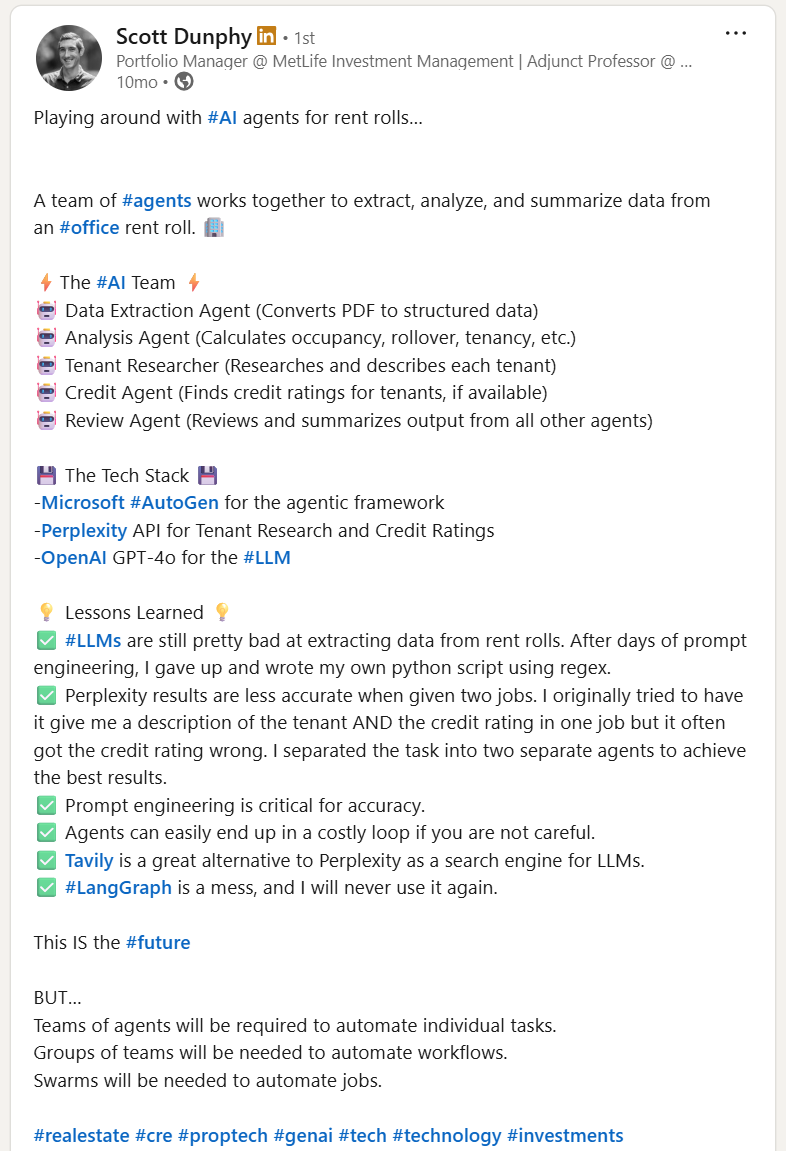

This LinkedIn post by Scott Dunphy sums up where we are with monthly reporting package reviews, and even though it was 10 months ago, it still holds true. He only focused on rent rolls here but it’s true for the rest of monthly reporting. Also, I highly recommend you read the comments if you’re wanting to try out some of these tools.

We’re not at a level with AI today where we can just plop into it all of our monthly reporting package and say “here you go! What should I do about this?”

Before all the founders who read this start pestering me, there are already point solutions tackling parts of this problem. Proda processes rent rolls. Canopy Analytics helps with PM-to-AM communication in multifamily. Vizibly supports multifamily budget reviews. But we’re not talking about each of those in isolation. Because taken individually, those tasks are generally more of an effort for operators and PMCs (except rent rolls). We’re talking here about the monthly reporting package for PE real estate teams and what the asset management team should do about it.

I find it highly unlikely that someone will take the time to split up each of these documents and upload them into a bunch of different systems — even if they automated that, they’d then have to find a way to consolidate the outputs, and all of these tools are just too early on to have a way to simplify that process for the non-developer (the software kind).

The same goes for annual budget reviews and cash flow forecasting.

If you want to take Scott Dunphy’s approach and if you know a bit about coding, then I’d tackle each category step by step and build an automation around it using the best suite of tools. The good news is that for highly structured data, like in tables, LLMs are getting pretty good at parsing that. For example, if you store historical property financial data, then you can extract the current month’s data from your PDF monthly reporting package MUCH easier now and automatically perform trend analysis in your favorite LLM. (Don’t forget to compare prior month’s data to the previous export you received. Too many managers and operators forget — or if you’re unlucky, “forget” — to send you updated financials with prior month adjusting entries. Which, by the way and as a CPA, they should not be doing unless they’re correcting an error and publishing and sharing restated financials.)

For quarterly re-underwriting, comp data has significantly improved. As a proud team member of HelloData, we cannot recommend them enough for multifamily asset managers looking to update their rent roll projections in their quarterly re-underwriting. But there are still so many other inputs to an underwriting model that I don’t know that we can fully turn off our brains and rely on an AI/LLM to generate one accurately for us with no review. Especially if you’re unsure of how to review the code behind the scenes.

Of course, AVMs or automated valuation models have been around for ages; these use AI to generate a value of your property without you having to lift a finger. But since most CRE investment managers get paid for the alpha they bring, I doubt we’ll see this automated away for some time, especially not by a third party software. Rather, I think we’ll see more of the hedge fund model where you have quants in-house building these models with AI in the not-so-distant future. I digress.

You can, absolutely, use AI to help speed up tasks within a model. Borrowing from yet another wonderful example of Scott’s, check out how to use Copilot to create a sensitivity analysis.

One other tool worth noting that asset management teams can and should be using is task management. It could be Trello, Asana, Notion, Jira, Dealpath, Altrio, the list goes on and on. Just use one. Most of these tools are now enhanced by AI, but the big win here is simple, transparent project management.

What does this mean for asset managers? Well, if they put in the work, they can certainly automate some of their financial and valuation tasks. In practice, any time saved here tends to get redeployed into better internal and external communication within this category, not fewer hours worked.

How automatable is this part of the job today (out of 5 stars): ⭐⭐⭐

How much time do asset managers save (again out of 5 stars): ⭐⭐

2) Debt & Capital Structure

Covenant tracking and compliance reporting (debt compliance and covenant management, including preparing/reviewing lender compliance packages, managing any options/swaps or similar and interest rate caps, and managing maturities across the portfolio)

Refinance and recap execution

Interest-rate hedging oversight

Lender communication and waivers

This is where AI is already delivering real leverage, quietly and without much controversy.

If I had a dime for every startup that pitched me on “our AI can read and organize data from your real estate documents and no one’s done it before” then I’d be turning and turning and turning. A quick Google search (yes, I still use Google sometimes) of “private credit real estate loan document AI” revealed a lengthy list of companies serving this space, including V7 Labs, Tenor, and Blueflame to start. LLMs have become so effective at reviewing legal documents that I’m not surprised at the irruption of new AI companies for loan docs. And if it works for private credit, you can probably use it for your loans as an equity investor. Or stick with tried and true apps like LoanBoss.

All that to say, there are plenty of tools to help you with debt covenant tracking and compliance reporting.

For executing refinances, recaps, and lender comms, LLMs definitely help here too. I do a fair amount of work with legal, and I always have an LLM spot-check my review before sending to our legal team and then again before saying something is “done”. It’s like a very cheap, very useful legal intern (with way more knowledge than an intern!).

The crazy thing about monitoring interest rates for swaps, hedges, or other options you may have, is that back in my day, you had to write a lot of code to set this up yourself. These days, you can have a tool like Replit or Claude Cowork do 99% of the monitoring work for you (this is assuming you’re not comfortable with using a terminal-based AI tool or copying code from an LLM into the appropriate setup). However, AI only handles monitoring and alerting, not trade execution.

What does this mean for asset managers? Lots of the humdrum has been taken out of covenant tracking and document review. Further, you can use the same technical skills with AI tools like Copilot to help automate scenario analysis or other AI tools to monitor hedging oversight. You can even use LLMs to draft your communications with lenders.

How automatable is this part of the job today (out of 5 stars): ⭐⭐⭐⭐

How much time do asset managers save (again out of 5 stars): ⭐⭐⭐⭐

3) Operations Oversight

Weekly/monthly PM or operator calls

Action-item tracking and follow-through

CapEx approval, tracking, and ROI analysis

Construction and renovation oversight

This category isn’t about analysis — it’s about follow-through, and that’s where most value is lost.

I’m going to sound like a broken record here, but if your firm allows it for asset management work, I cannot recommend enough getting an AI notetaker like Fellow and having it attend every meeting. Then, connect Fellow to Asana or Trello or whatever task management software you use. Fellow will automatically determine to-dos from your meeting and assign them out in your task management software. This makes it easy for you and your teams to track what needs to be done.

Of course, your operators and PMs may not use your same task management software. But at least this way, you’ll have a record of what each party agreed to do.

For capex and construction/renovation work and oversight, most of the time, this will still have some manual components… unless you’re willing to spend on cameras. My friends in the AEC (architectural, engineering, and construction) industry shared with me previously just how good these cameras and associated software are getting at identifying what part of the construction the project is in, what milestones have been hit, any potential issues with the build, etc. It’s impressive, and that’s exactly the kind of work — image recognition — that AI today is so good at. And there are all the construction project management tools like Procore, Northspyre, Rabbet, etc. which aren’t originally AI-powered but do help get the job done.

Before you even get to capex projects you have to decide whether to invest that money. Someone, probably an asset management analyst or perhaps the investment analyst before acquisition, did a return on investment (ROI) analysis to see whether or not those dollars were worth spending. I have yet to hear of a tool that automates this with perfection, BUT I can say that we’ve been using ChatGPT to make estimates all the time on our personal home build before getting subcontractor bids. And it’s not bad. That said, I wouldn’t rely on it without human review. But with the right specificity of query, you can get some fair cost estimates as a starting point. Then, you can use many of the amazing data sources available to project attainable rents (ahem, HelloData, or for CRE, CoStar, CompStak or similar).

What does this mean for asset managers? Better follow-through, earlier escalation, and less operational leakage without micromanaging day-to-day work. At the end of the day, though, I’m not convinced that a ton of time is saved here.

How automatable is this part of the job today (out of 5 stars): ⭐⭐⭐⭐

How much time do asset managers save (again out of 5 stars): ⭐⭐⭐

4) Data Integrity & Controls

Bank reconciliation review

Fraud detection and anomaly review

Approval workflows and audit trails for necessary approvals (capex, draws, distributions)

System and reporting QA

This is the least glamorous part of the job. And the most dangerous to get wrong.

So technically, the bank reconciliation review is part of the monthly reporting package. At least typically. Why am I repeating it here?

Because this is one of the many areas where things could go very badly if you’re not doing your fiduciary duty for investors.

If you’re a PE real estate firm, your operator or PM team will prepare the bank reconciliation. All you have to do is review it to make sure it’s right and reasonable. But each property has several bank accounts, and you have a lot of properties to manage. Sure would be nice to automate this somehow, right? And with a bit of upfront work, I think you can.

Claude, ChatGPT, Gemini, etc. are all pretty good at reading and interpreting standard documents (or images of documents) now. If you stored in your database what the starting and ending bank balance should be for that month, then (working with the APIs, not in chat) you should be able to have your AI tool extract those balances and compare them to the appropriate GL accounts for each bank. This will require you to have solid records of each bank account at each property, and to have documented it appropriately in your database.

Most of you probably won’t want to do the fairly significant amount of upfront work to set this up, and knowing how crazy your job can be, I don’t blame you. But I found bank recons to be one of the most tedious parts of the job, and if you can put in the hours (or have your intern help) to have AI do the first look here, I’m sure that would save your sanity. It would have saved me more hours than I care to admit!

Similarly, if you have your property level financials and rent rolls extracted into a database or even an Excel file, you could have your favorite AI tool run an analysis comparing month over month, quarter over quarter, year over year, etc. to see what trends pop up. I used to be a Power BI power user, and I can honestly say that I have moved away from BI for this type of analysis. It’s much more efficient and effective to have an AI tool do the first pass at data analysis, even creating the charts you want. (Again, as long as you’re comfortable reviewing the code behind it.)

This isn’t AI, but we also used to compare things like whether or not the property had the same unit #s both for multifamily and commercial. This helped flag any property changes that may have occurred that we hadn’t confirmed yet with the operator or PM, e.g. they did start work on converting the extra janitorial room into a new unit. AI would definitely have helped with converting the rent rolls cleaner!

Approval workflows still require a human, and as such, not much AI can do there. Most “nudging” that happens to remind users to do a thing is still rules-based.

We’ll talk more about system and reporting QA when we talk about the data roles at real estate firms. For now, just know that asset managers are approached when there’s any data that looks funny (aka data governance). And I’m betting good money that AI would troubleshoot that better.

What does this mean for asset managers? You get to remove the drudgery, enhance your analysis, but still have to talk to people.

How automatable is this part of the job today (out of 5 stars): ⭐⭐⭐

How much time do asset managers save (again out of 5 stars): ⭐⭐⭐⭐

The biggest unlock with AI in asset management isn’t speed; it’s consistency. Fewer dropped balls, fewer surprises, and fewer late-night CIO calls explaining something you could have caught earlier.

More on the joys of asset management — and the art of the possible with AI — in next week’s post.

Like this? I write weekly about real estate, tech, and the messy stuff that happens between smart people and good intentions.

👉 Subscribe here to get the next one.

Jen’s Reading Corner

I keep being sent articles about power generation. In response, I keep sending back Packy McCormick’s The Electric Slide post from last year. If you haven’t read it yet — or at least skimmed it given the length — you should. Great find by my husband and especially great find on the induction stove by Impulse, whose founder was the coauthor of this piece.

If you like All About CRE and want to support my work:

💎 How to upgrade to a paid subscriber from a free one

☕ Buy me a coffee

📧 Forward this to a friend and invite them to subscribe at jentindle.substack.com

Fascinating that this piece, it seems to me (and relative to your others in this series!) has more areas where people are actively building their own agents. Is it an opportunity for founders or a sign of the complexity of the challenge?

Excellent analysis; it really makes me wonder if AI could simplify the complexity of tracking narrative threads in my books as efficently as it clears up financial reporting for asset managers.